Last updated: May 2023

Resources for Japanese Immigrants and Japanese-American Business Owners

The resource page provides information in Japanese about assistance programs announced by the federal government, the state of Washington, and other public facilities that are available to small businesses and microbusinesses. For more information and to apply, please visit the respective websites.

*If there is any difference between the original text and the Japanese translation, please refer to the website of the organization providing the program.

*JASSW strives to introduce the main programs; however, there may be other programs not limited to those listed here.

Need Assistance? Contact to Small Business Resiliency Program:

smallbiz@jassw.org SmallBiz@jassw.org

Weekly Sittoku Jyoho (Useful Information) from JASSW

(Latest 10 posts)

| 136 | June 26, 2025 | Who Gets the Tip? – Quiz #3 |

| 135 | June 19, 2025 | Best Practices in Form I-9 Compliance for Small Businesses |

| 134 | June 10, 2025 | WA Employee Ownership Alert |

| 133 | June 4, 2025 | Overtime Pay? or Not? Quiz Time! -2 |

| 132 | May 28, 2025 | Overtime Pay? or Not? Quiz Time! |

| 131 | May 21, 2025 | Grant opportunity available for businesses located in King County |

| 130 | May 14, 2025 | Navigating ICE Audits and Business Succession – Expert Panel |

| 129 | May 7, 2025 | Who Gets the Tip? – Quiz #2 |

| 128 | April 30, 2025 | Who Gets the Tip? – Quiz |

| 127 | April 24, 2025 | Dress Code vs. Uniform – What’s the Difference? |

Finance / General Support

How to obtain a Washington State Business License

2023/2月 update You Tube video – How to Obtain a Washington State Business License – For Sole Proprietors in City of Lynnwood

How to Obtain a Washington State UEI Number

UEI number will be required to receive grants, loans, and contracts (jobs) from the Government, so if you are considering it, please obtain it first before applying for grants, etc.

Small Business Guide (Japanese version)

2023/9 – Small Business Guide (Japanese Version) had issued by the Governer’s Office ORIA.

It is useful as a guidebook for all small business’ owners.

Emergency Preparedness Document for Business Owners

2025/5 – Emergency Preparedness Document for Accounting and Operations – Click HERE to download.We encourage business owners to fill out the following information and store it in a secure location as part of your emergency preparedness plan. This may be invaluable in times of crisis.

For more details, please listen to Episodes 97, 98, and 99 of our podcast, JASSW Small Business Bites.

Your Go-To Resource for Washington Small Business Recovery Assistance

A website developed in partnership with the Washington State Small Business Recovery Working Group to provide current and accurate information on the available relief programs for Washington’s small businesses and eligible non-profits, as well as those organizations that assist them.

Learn more at https://www.smallbizhelpwa.com/

Small Business Flex Fund

What: Low interest working capital loans for business with fewer than 50 employees, less than $3 million annual revenue who have experienced direct economic hardship due to COVID-19. Small businesses and nonprofits can borrow up to $150,000 and the money can be spent flexibly, including on payroll, utilities & rent, supplies, marketing & advertising, building improvements or repairs, and other business expenses.

Learn more about the Small Business Flex Fund here.

The Employee Retention Credit (ERTC)

What: A refundable credit that businesses can claim on qualified wages paid to employees, including certain health insurance costs. It was developed to help safeguard jobs during the health crisis by supporting business owners. The ERTC is available to any business owner who has kept on employees during the health crisis. The new rules mean business owners can claim up to $28,000 in relief per employee in 2021.

Learn to see if you qualify here: https://scotthall.co/employee-retention-tax-credit/

Learn more about the Employee Retention Credit here

Export Voucher Program

What: Direct cash assistance to qualifying small businesses to help them expand their international sales. Export vouchers can reimburse eligible export expenses up to $10,000 depending on the expense.

Click here to learn more about the Export Voucher Program.

SBA Debt Relief

What: SBA offers debt relief to existing SBA loan borrowers whose businesses have been impacted by COVID-19. As a part of the CARES Act, SBA is authorized to pay six months of principal, interest, and any associated fees that borrowers owe for all 7(a), 504, and Microloans reported in regular servicing status (excluding Paycheck Protection Program loans).

Click here to learn more about SBA Debt Relief.

NEW! Deferment extension as March 15, 2022

Due to the continued adverse effects of the COVID-19 emergency, SBA is providing an additional 6-month deferment of principal and interest payments to existing COVID EIDL borrowers. This deferment does not apply to non-COVID disaster home and business loans.

This deferment extension is effective for all COVID-EIDL loans approved in calendar years 2020, 2021, and 2022. Loans now have a total deferment of 30 months from the date of the Note. Interest will continue to accrue on the loans during the deferment.

More detailed information about eligibility and how deferment impacts your future loan payment amounts can be found in SBA procedural notice 5000-830558 dated March 15, 2022.

SBA Mentor Protégé Program

What is it? A program that helps eligible small businesses (protégés) gain capacity and win government contracts through partnerships with more experienced companies (mentors).

To qualify as a protégé, your business must:

・Be a small business with industry experience

・Have a proposed mentor prior to applying for the program

・Be organized for profit or as an agricultural cooperative

・Have no more than two mentors in the business’ lifetime

To learn more about the SBA Mentor Protégés Program, click here.

Paycheck Protection Program(PPP)

NEW! The Restaurant Revitalization Fund is likely to be replenished.

On April 7 the US House passed legislation to add $42 billion to replenish the Restaurant Revitalization Fund (RRF). According to the National Restaurant Association, the US Senate appears likely to vote on a plan to partially or fully replenish the RRF, offering it as an amendment to a $10 billion COVID Preparedness bill. In addition, this bill will establish a new program to support the hardest-hit small businesses – delivering critical assistance to small businesses that have suffered revenue losses of at least 40 percent during the pandemic. The vote on the federal “Relief for Restaurants & Other Hard Hit Small Businesses Act” will likely be after the Senate’s upcoming two-week recess period, in late April or early May. This will likely be the last vote Congress takes on RRF replenishment! JASSW will provide updates as they become available. If you are a restaurant owner who may be eligible for the second round of the RRF, please check back our site often.

Navigate PPP forgiveness, Employee Retention Tax Credits, and financial record-keeping for the Restaurant Revitalization Fund

What: Free accountant consulting services for small businesses to help employers navigate PPP forgiveness, Employee Retention Tax Credits and financial record-keeping for the Restaurant Revitalization Fund.

The Certified Public Accountant (CPA) assistance is available to Washington businesses with 100 employees or fewer. Employers can reach out to Leigh (leighj@seattlechamber.com) to get connected with an accountant at Clark Nuber.

Paycheck Protection Program – Loan Forgiveness

Borrowers may be eligible for Paycheck Protection Program (PPP) loan forgiveness.

Paycheck Protection Program borrowers: If your loan is $150,000 or less, you may be eligible to apply for direct forgiveness through SBA using our online portal. Follow the steps below.

1. Find out if your lender is participating.

2. Watch a video about how to use the portal.

3. Apply for forgiveness.

For more information about loan forgiveness, click here.

For Women-Owned Businesses

Getting Certified as a Woman Owned Small Business (WOSB) or Economically Disadvantaged Woman Owned Small Business (EDWOSB)

Why get certified? To help provide a level playing field for women business owners, the government limits competition for certain contracts to businesses that participate in the women’s contracting program. Some contracts are restricted further to economically disadvantaged women-owned small businesses (EDWOSBs).

Register to contract with the government as a Woman Owned Small Business or Economically Disadvantaged Woman Owned Small Business by going to https://beta.certify.sba.gov/

For more information about the WOSB and EDWOSB, click here.

For Veteran-Owned Small Businesses

Getting Verified as a Veteran-Owned Small Business

Why get verified? Small businesses owned by veterans can compete for set-aside contracts at the Department of Veterans Affairs (VA). Through its Veterans First Contracting program, VA awards a large amount of contract dollars to veterans every year by offering set-aside contracting opportunities. VA also sets aside contracting opportunities for businesses owned by veterans who are service-disabled.

For more information about getting verified as a Veteran Owned Small Business, click here.

Service-Disabled Veteran-Owned Small Business Program (SDVOSB)

Why participate? The federal government aims to award at least 3% of all federal contracting dollars to Service-Disabled Veteran-Owned Small Businesses (SDVOSB) each year. Joining the SDVOSB program makes your business eligible to compete for the program’s set-aside contracts. You can still compete for contract awards under other socio-economic programs you qualify for.

For more information about the SDVOSB, click here.

Surplus Personal Property for Veteran-Owned Small Business Program

Why participate? Veteran-owned small businesses can access federally owned personal property no longer in use through the General Services Administration’s (GSA) Federal Surplus Personal Property Donation Program.

For more information about this program, click here.

For Small Disadvantaged Businesses

Getting Certified as a Small Disadvantaged Business

Why get certified? Each year, the Federal Government awards about 10% of all federal contract dollars, or roughly $50 billion in contracts, to Small Disadvantaged Businesses.

Who is presumed socially disadvantaged individuals? Black Americans, Hispanic Americans, Native Americans, and Asian Pacific Americans

Register to contract with the government as a Small Disadvantaged Business by visiting https://sam.gov/

For more information about small disadvantaged business certification, click here.

8(a) Business Development Program

What is it? A nine-year program designed to help small disadvantaged businesses compete in the federal procurement market. Businesses that participate in the program receive training and technical assistance designed to strengthen their ability to compete effectively in the American economy

To get certified as an 8(a) business, simply go to the certify.SBA.gov website. You’ll have to have a profile at SAM.gov before you can use the certification website.

Learn more about the 8(a) program here.

HUBZone Program

What is it? A program that fuels small business growth in historically underutilized business zones with a goal of awarding at least 3% of federal contract dollars to HUBZone-certified companies each year.

Why participate? Joining the HUBZone program makes your business eligible to compete for the program’s set-aside contracts. HUBZone-certified businesses also get a 10% price evaluation preference in full and open contract competition.

What can be designated as a HUBZone?

・Urban – census tracts

・Rural – countrywide

・Federally Recognized Disaster Areas

・Native American reservations

・Closed Military facilities (BRAC)

Learn more about the HUBZone Program here.

Learn to see if you qualify at the SBA’s Certify website.

Business Workshops

Seattle Public Library

Did you know you can book a free virtual 1:1 appointment with a librarian trained in business research?

The librarians can help you find information about your industry and market, potential customers, competitors, and make referrals to business assistance organizations. They will also help you access workshops and classes designed to help you improve your business skills.

Make a Business Appointment with the Seattle Library! Just book a session here.

The library also offers free legal consultations for entrepreneurs!

Just register for one of the “UW Entrepreneurial Law Clinic – Virtual Consult – Corporate Law” sessions on their Business Appointment Page.

You’ll receive a 30-minute consultation with an attorney who has expertise in intellectual property law (patents, trademarks, trade secrets, copyrights, etc.) or legal entity formation (contracts, equity, etc.)

These resources are state-wide and you do not need a library card to attend these appointments.

Check out the library’s other business workshops here.

Benefits for Small Businesses

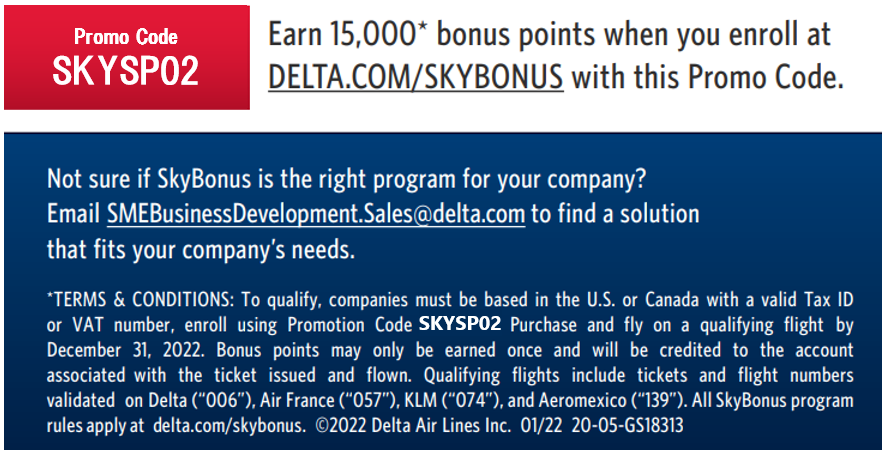

Delta is here for small businesses, now more than ever. SkyBonus is a travel rewards program for small to mid-sized companies that turns every business travel dollar your company spends into SkyBonus points. Your company can redeem those points for valuable rewards such as flight certificates, upgrades, Delta Sky Club® passes, and more – all while your employees continue to earn their miles in the SkyMiles® program. Use promo code SKYSP02 for 15,000 bonus points!

More details can be found here.